Letting your money work for you sounds like a dream—until you realize it is actually possible. For many people, investing can feel overwhelming, especially with all the constant market updates and expert opinions. But there is a simpler approach that does not require daily monitoring or complex strategies.

This blog explores how passive investing will help you build wealth over time with less effort, more consistency, and greater peace of mind. Whether you are just starting out or looking to grow your savings steadily, you will find that this method offers a practical path toward your financial goals.

What is Passive Investing?

Passive investing is a strategy where you invest your money in a way that requires little ongoing effort. Instead of actively buying and selling stocks to try to beat the market, you invest in a broad mix of assets like through index funds or exchange traded funds (ETFs) and simply let your investment grow over time.

The goal is to match the overall performance of the market, not beat it. This approach often leads to lower fees, fewer risks from frequent trading, and more consistent long-term results. It is a smart option for investors who want a hands-off way to grow their wealth steadily.

Active vs Passive Investing

Active and passive investing are two different ways of managing investments. In active investing, a fund manager or individual investor carefully selects which stocks or assets to buy and sell. The goal is to outperform the market or to achieve market-like returns with lower risk or volatility. This approach often involves researching companies, analyzing trends, and regularly adjusting the portfolio to meet a specific investment objective.

On the other hand, passive investing follows a more straightforward and consistent approach. Instead of trying to beat the market, it aims to match the performance of a market index, such as the PSEi (Philippine Stock Exchange Index) or the S&P 500 (Standard and Poor's 500 Index). Passive investors typically build a portfolio that mirrors the composition of a chosen index or benchmark. This strategy involves buying and holding investments for the long term with little trading activity.

As a result, passive investing tends to be more cost efficient, since it involves lower transaction costs and management fees compared to active strategies.

Key Factors to Weigh When Choosing Your Investment Strategy

Choosing between active and passive investing depends on several personal and financial factors that can guide you toward the approach that best fits your needs and goals. Here are some key factors to consider:

Risk Appetite

Active investing generally requires higher engagement and a stronger tolerance for risk, as it relies on short-term market movements that are unpredictable. Passive investing aims to reduce risk by spreading investments across a wide range of assets that reflect the composition of a market index or other benchmark. This strategy assumes that markets will grow over time, offering more stable returns for long-term investors.

Cost and Fees

Active investing usually comes with higher costs due to frequent trading and the need for constant portfolio management. These costs can add up quickly and eat into potential gains. Passive investing is typically more cost efficient since it involves fewer transactions and lower management fees.

Time Commitment

Active investing takes more time and effort. Investors need to constantly monitor market news, study trends, and make timely decisions to meet short-term goals. In contrast, passive investing is more suited to those who prefer a hands-off approach or are focused on long-term objectives.

Experience Level

Active investing often requires a deeper understanding of the market, as success depends on well informed decisions and timely actions. Passive strategies are more accessible for beginners or those who prefer a simpler way to invest without needing to stay updated on every market move.

Investment Goals

Your strategy should match your personal goals. If your aim is to beat the market and you are comfortable with more risk and involvement, active investing might be a better fit. If your focus is long-term growth with less effort and lower costs, passive investing may be the more suitable choice.

Benefits and Challenges of Passive Investing

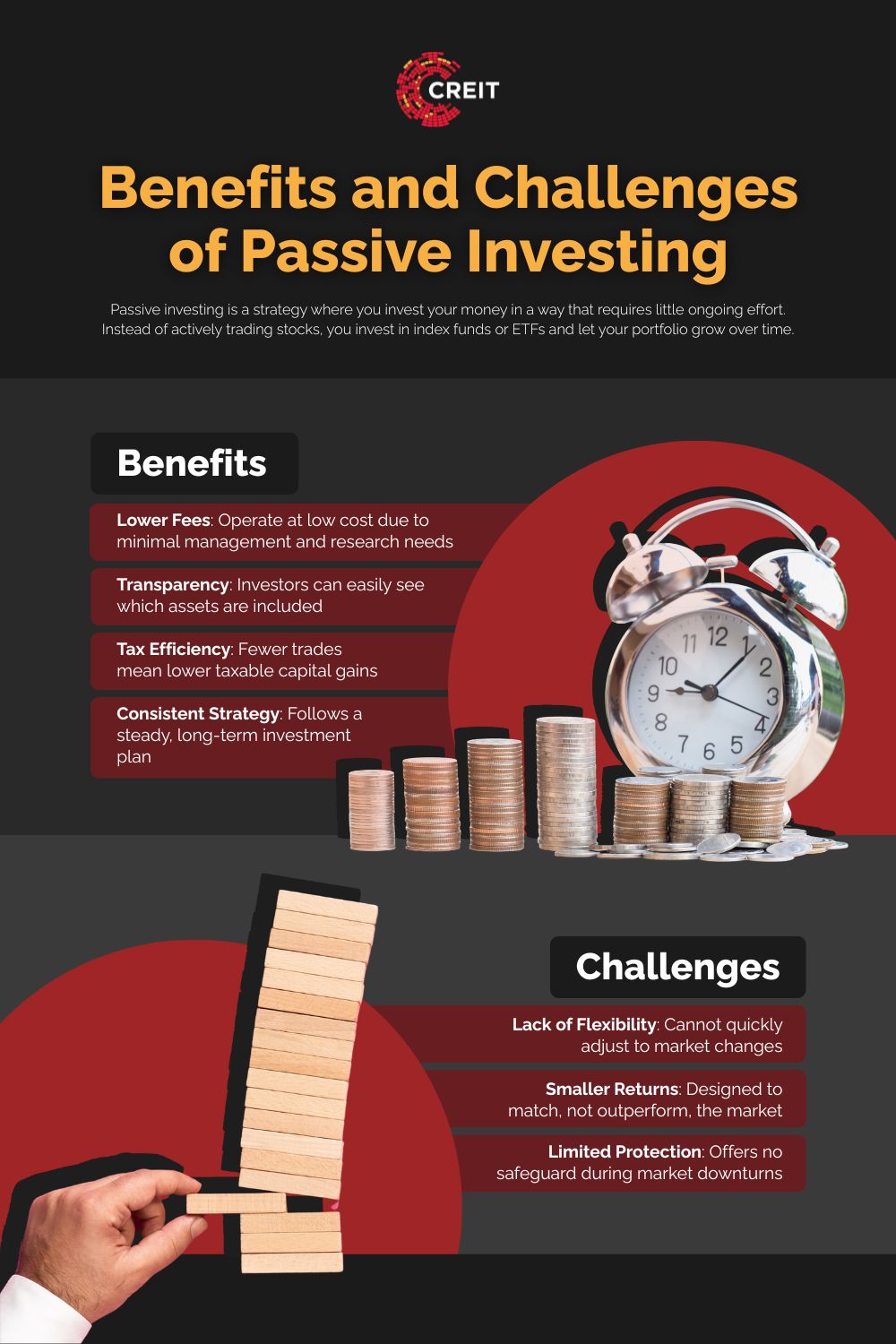

Passive investing offers several advantages, but it also comes with its own set of challenges. Here are some key benefits and challenges to consider:

Benefits

- • Lower Fees: Passive funds rely on straightforward formulas to build their portfolios, which removes the need for costly research and management. This makes them cheaper to operate compared to active funds.

- • Transparency: It is easy to know exactly what you are investing in because index funds clearly show which assets they hold.

- • Tax Efficiency: Since passive funds follow a buy and hold strategy, they often generate little to no taxable capital gains each year.

- • Consistent Strategy: Passive investing sticks to a set plan, making it easier for long-term investors to stay focused on their goals.

Challenges

- • Lack of flexibility: Passive funds are tied to a specific index or group of assets and cannot quickly adjust their holdings even when market conditions change.

- • Smaller potential returns: Since they are designed to match the market, passive funds rarely outperform it, even during times when active strategies might gain more.

- • Limited downside protection: Passive funds follow the market whether it goes up or down, offering no built-in protection during sharp declines.

How to Start Passive Investing

Passive investing is an easy and practical way to build long-term wealth, especially for those who prefer a low maintenance approach to growing their money. One of the most common ways to begin is by investing in mutual funds or ETFs that follow a passive investment strategy. These funds are designed to track the performance of a specific benchmark, such as the PSEi or S&P 500. Once you invest in these funds, you do not need to manage them actively—they are built to follow the market with minimal adjustments.

To get started, you will need to open a brokerage account. Choose a reliable platform that gives you access to index funds or ETFs and allows you to buy and hold them with ease. Once your account is set up, decide how much you want to invest and which index fund best aligns with your long-term goals and risk tolerance.

It also helps to schedule regular investments, such as monthly contributions, to build your portfolio steadily over time. This approach, often called cost averaging, can reduce the impact of market ups and downs and help you stay consistent. Lastly, make sure to review your investments occasionally to ensure they still match your financial goals—but remember, the strength of passive investing lies in staying the course.

Build Wealth Steadily with a Reliable, Passive Income

Passive investing is all about building steady wealth with minimal effort and lower costs. Instead of constantly adjusting your portfolio, you invest in assets designed to deliver steady returns over time. One smart way to apply this strategy is by choosing real estate investment trusts (REITs), which offer regular income through property rentals without the need to manage the properties yourself.

If you are looking for a reliable REIT in the Philippines, consider Citicore Energy REIT Corp. (CREIT). It focuses on renewable energy real estate, giving investors the opportunity to earn from clean energy projects while supporting sustainability. As the Philippines’ first energy-themed REIT, CREIT is well-positioned for long-term growth. To learn more about why we are a strong option for passive investors, check out the advantages of investing in CREIT today.