Earning money while you sleep is possible with the right investments. Investors who prioritize income over short-term gains often look at dividend-paying stocks as a way to build wealth steadily over time. In the Philippines, numerous companies listed on the Philippine Stock Exchange (PSE) share a portion of their profits with shareholders, creating opportunities for both consistent income and long-term financial growth.

Whether you’re new to investing or have been at it for years, dividends can be a key strategy in building a strong, diversified portfolio. Read on to learn how dividends work and why they’re an essential consideration for your investment strategy.

What is a Dividend?

A dividend is a portion of a company’s earnings that is distributed to its shareholders as a reward for investing in the business. It is usually paid in cash, but in some cases, it can also come in the form of additional shares of stock.

For many Filipino investors, dividends offer a steady source of income, especially when investing in established companies listed on the PSE. These payouts are typically given on a regular basis—such as quarterly, semi-annually, or annually—depending on the company’s dividend policy. For instance, This practice underscores the role of dividends as a significant component of investment returns for Filipino investors.

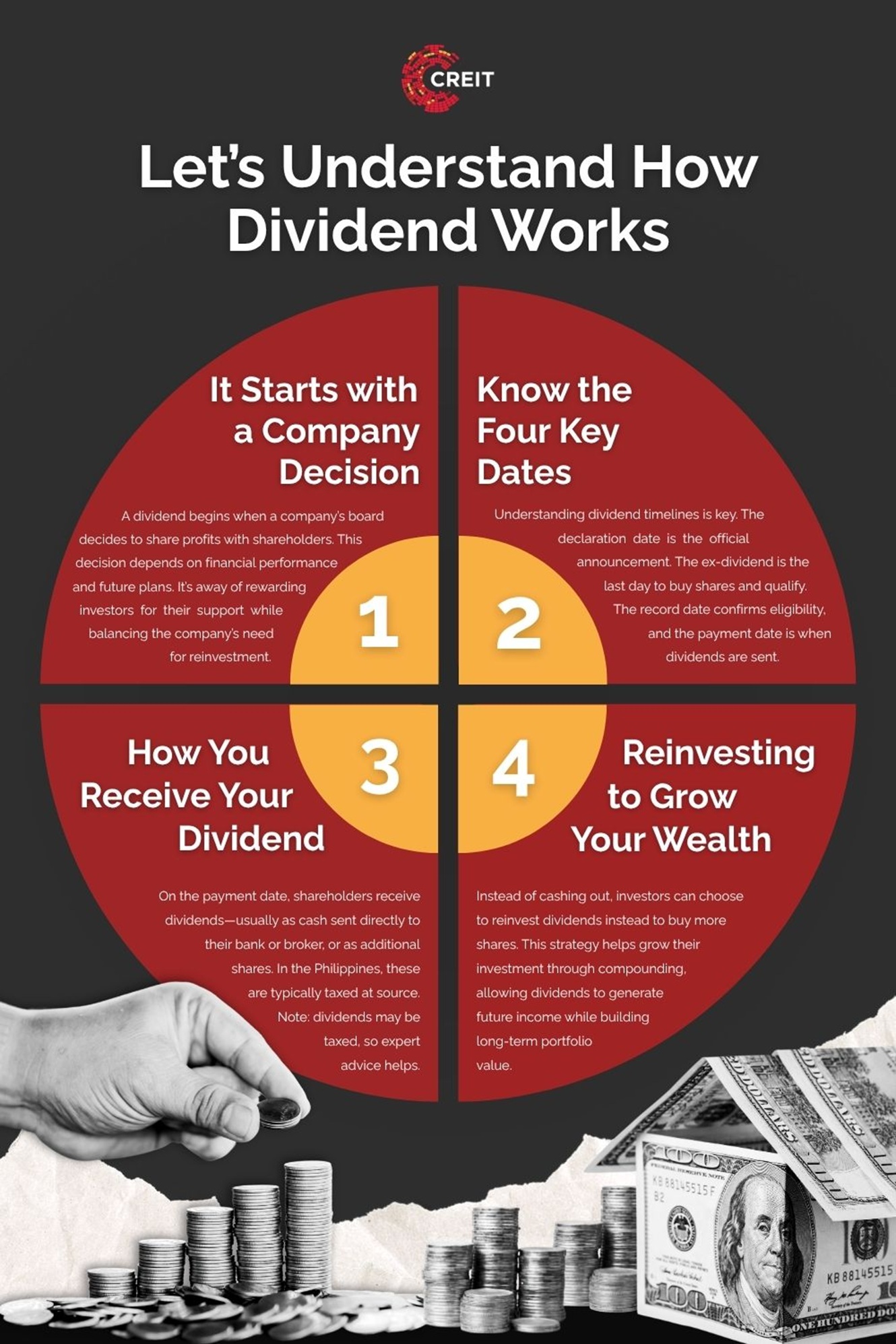

A Simple Breakdown of How Dividends Work

Dividends may seem straightforward—receiving a portion of a company’s profit—but the process involves a few important steps and key dates that every investor should know. Here's a clear explanation of how dividends are declared, distributed, and even reinvested for long-term growth.

Step 1: The Company Decides to Pay a Dividend

The process begins when a company earns a profit and decides whether to share a portion of that profit with its shareholders. This decision is made by the board of directors and depends on the company’s financial health, growth plans, and long-term goals. Once approved, the company announces the dividend amount and the schedule.

For example, in 2024, SM Investments Corporation (SM) increased its dividend payout to ₱9.00 per share—up from ₱7.50 in 2023—reflecting strong financial performance and a commitment to rewarding investors.

Step 2: Important Dates You Need to Know

There are four key dates that Filipino investors should remember when dealing with dividends: (1) the declaration date, when the dividend is officially announced; (2) the ex-dividend date, which is the last day you can buy shares and still qualify for the dividend; (3) the record date, when the company identifies who is eligible to receive the dividend; and (4) the payment date, when the dividend is actually paid out.

For example, the PSE declared a ₱10.00 per share dividend in 2024, with the declaration date and ex-dividend date both on March 7, the record date on March 8, and payment on April 5.

Step 3: Receiving Your Dividend Payment

On the payment date, shareholders who held the stock on the record date will receive their dividends. These can be paid in cash or as additional shares. Cash dividends are typically deposited directly into your bank or brokerage account.

For instance, BDO Unibank, Inc. (BDO) gave out a total of ₱3.75 per share in cash dividends in 2024, with payments made automatically to eligible investors. While receiving dividends is relatively hassle-free, it’s important to consider that these earnings may be subject to taxes, so it’s wise to consult a financial adviser or tax professional.

Step 4: Reinvesting Dividend Income for Growth

Instead of withdrawing the cash, many investors choose to reinvest their dividends to buy more shares of the same company. This strategy helps grow your investment over time through compounding. Some companies offer Dividend Reinvestment Plans (DRIPs), while others allow reinvestment through online brokerage platforms.

For example, if you received dividends from Manila Electric Company (MER) in 2024, you could use those funds to purchase more MER shares, increasing your future dividend potential and overall investment value. Reinvesting is especially useful for long-term investors focused on wealth-building.

Different Types of Dividends

Dividends come in various forms, each offering unique benefits to investors. Understanding these types helps you make better decisions when choosing which companies to invest in. While cash dividends are the most common, some companies offer alternative types of dividends depending on their financial strategies and available resources.

Cash Dividends

This is the most common type of dividend issued by companies listed on the PSE. Cash dividends are paid out in Philippine pesos directly to shareholders, usually through a bank or brokerage account. These payouts are straightforward and attractive for those looking for regular income.

Stock Dividends

Instead of giving cash, some companies issue additional shares to existing shareholders. This is known as a stock dividend. It increases the number of shares you own without affecting the total value of your holdings. Stock dividends are often viewed as a sign of long-term growth and confidence in the business.

Property Dividends

Though less common in the local market, property dividends involve the distribution of assets other than cash or stock. These could include shares in a subsidiary or other physical assets. This type of dividend is typically used in special situations, such as corporate restructuring.

Key Factors That Influence Dividend Payouts

Several factors influence a company's dividend payout policy. These include:

- • Profitability: Companies with higher profits are more likely to pay dividends. A stable and growing income allows firms to distribute profits to shareholders while maintaining their operations.

- • Cash Flow: Sufficient cash flow is necessary for dividend payments. Even profitable companies may avoid paying dividends if cash flow is limited.

- • Debt Levels: Companies with high debt may prefer to use their earnings to pay down liabilities rather than paying dividends.

- • Growth Opportunities: Businesses that are in growth phases or require heavy reinvestment in their operations may opt to reinvest profits rather than paying dividends.

- • Tax Considerations: If taxes on dividends are high, a company may opt for stock buybacks or reinvestment rather than dividend payouts.

The Importance of Dividends and How They Benefit Investors

From an investor's perspective, dividends offer several advantages:

- • Income Generation: Dividends provide investors with a regular income stream, making them particularly attractive to those seeking consistent returns, such as retirees or income-focused investors.

- • Stability and Predictability: Companies that pay dividends regularly often signal financial stability and confidence in their prospects. Reliable dividend payments can enhance investor confidence and trust in the company.

- • Long-Term Wealth Growth: Reinvesting dividends through dividend reinvestment plans (DRIPs) allows investors to harness the power of compounding, potentially accelerating the growth of their investment portfolios over time.

Secure Reliable Returns and Achieve Your Investment Goals with CREIT

If you're looking for a reliable source of income and long-term growth, Citicore Energy REIT Corp. (CREIT) is the perfect investment option for you. With a strong track record of consistent performance and a commitment to delivering steady dividends, we offer a stable opportunity for investors.

Take the next step in securing your financial future—invest in CREIT today and start building a portfolio with a trusted partner in real estate investment. Contact us now!