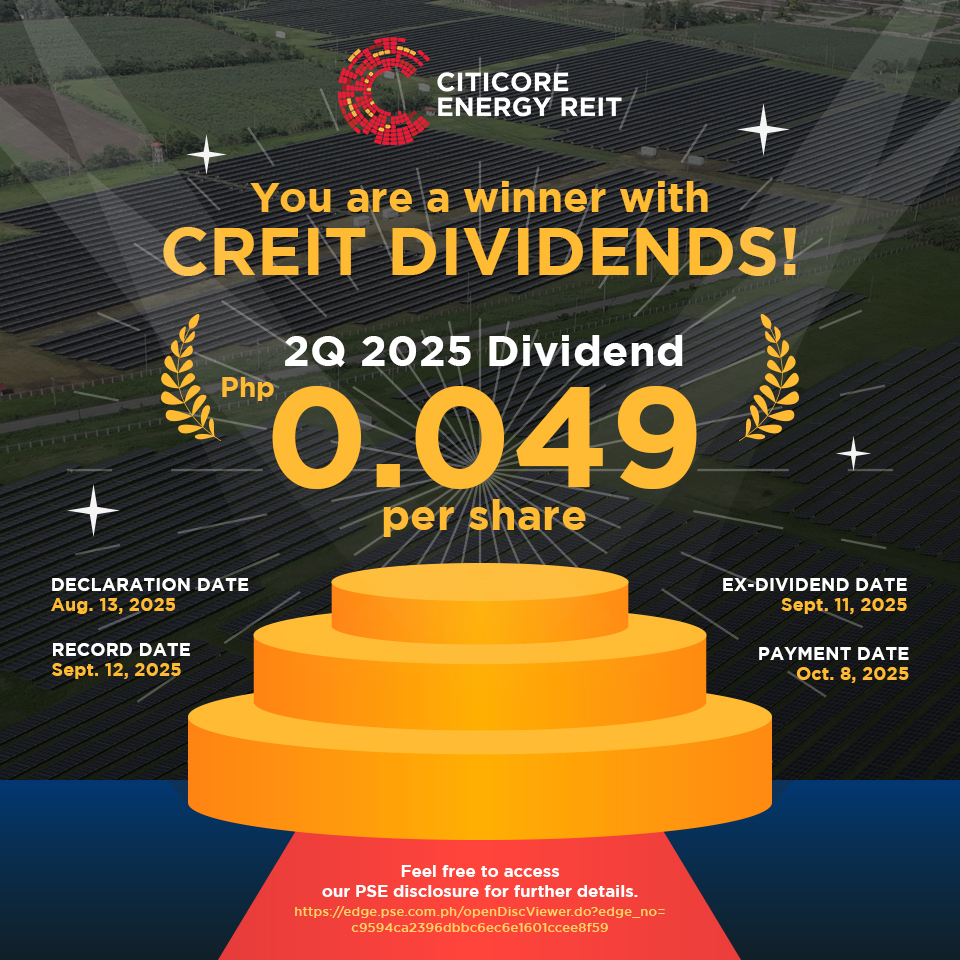

Citicore Energy REIT Corp. (CREIT or the “Company”), the country’s first and largest renewable energy REIT, declared dividends amounting to Php 0.049/share – consistent with declared dividends in the same period last year.

The company’s consistent dividends are driven by its stable revenue, EBITDA, and net income, owing from a slight increase in guaranteed base lease.

CREIT’s dividends of Php 0.049/share equates to an annualized yield of 5.6% based on 30 June 2025 closing price of 3.51/share. This will be payable on 08 October to shareholders on record as of 12 September.

“CREIT continues to be a strong leader among Philippine REITS, with our consistent revenues though our long-term lease agreements, backed by guaranteed base lease, built on the fact that we have 100% occupancy at all times. Our performance for the first half of the year translated to stable and consistent dividends which our shareholders enjoy, with our asset acquisition strategy poised to continue to grow CREIT's portfolio, translating to more attractive dividends,” said Oliver Tan, President and CEO of CREIT.

CREIT’s sponsor, Citicore Renewable Energy Corporation, is racing to energize its first gigawatt this year, part of its five gigawatts in five years goal. This gives CREIT a vast basket of potential asset acquisition, further solidifying its unique green asset portfolio. CREIT continues to bank on its 100% occupancy and an industry leader in terms of weighted average lease expiry (WALE) of 19.9 years – allowing the Company to consistently declare above-prescribed dividends since its listing in the Philippine Stock Exchange in February 2022.###