Citicore Energy REIT Corp. (CREIT or the “Company”) declared dividends amounting to Php 0.055/share – higher than the Php 0.054/share dividend declared in the same period last year. This consists of regular dividends coming from CREIT’s guaranteed base lease revenues from Q4 2024 and special dividends from variable lease revenues for the year.

CREIT’s variable lease revenues amounted to Php 50 million for the year, representing a 48% increase in the excess revenues earned by its lessees over base revenues. This was driven by the combined overperformance of actual versus base generation and higher contract renewal rates.

For the year 2024, CREIT has declared total dividends amounting to Php 0.202/share, which is the Company’s largest cash dividend declaration in a single year since listing in the Philippine Stock Exchange in 2022 and equates to an annualized yield of 6.43%, based on March 24 closing price of Php3.14.

“On its third year of operations, CREIT is proud to declare its highest quarterly dividend to-date. We remain committed to provide investors with a sustainable and attractive dividend-paying investment as we continue to grow the Company’s green asset portfolio, mirroring the the growth of its sponsor, Citicore Renewables as it continues to embark on its 5GW in 5-year journey.” said President and Chief Executive Officer Oliver Y. Tan.

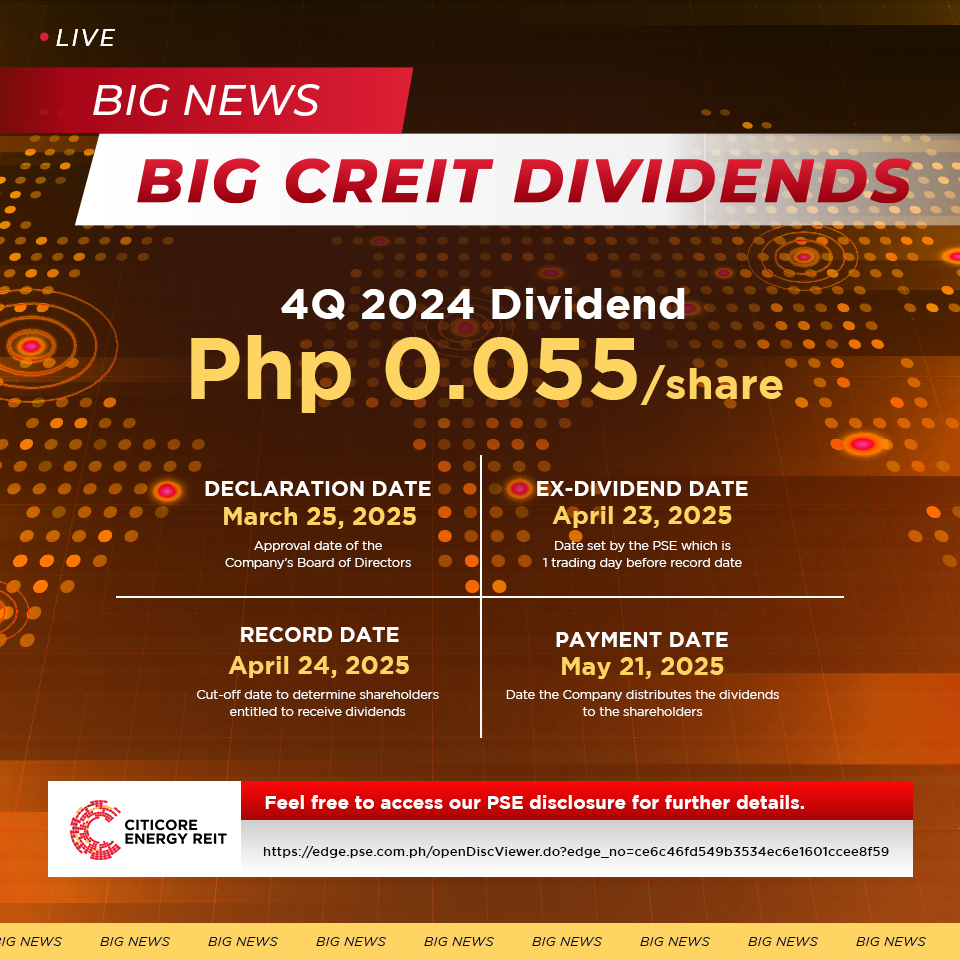

Dividends for the 4th quarter of 2024, amounting to Php 0.055/share declared on March 25, 2025, will be payable on May 21, 2025 to shareholders on record as of April 24, 2025.

CREIT’s sponsor, CREC, has a goal of 5 gigawatts (GW) in 5 years - with the 1st GW to be energized in 2025. CREIT’s unique green asset portfolio, with total landholdings of 7.1 million square meters and backed by 100% occupancy with a weighted average lease expiry of 20.69 years, has allowed the Company to consistently declare above-prescribed dividends since its listing in the stock market in February 2022.